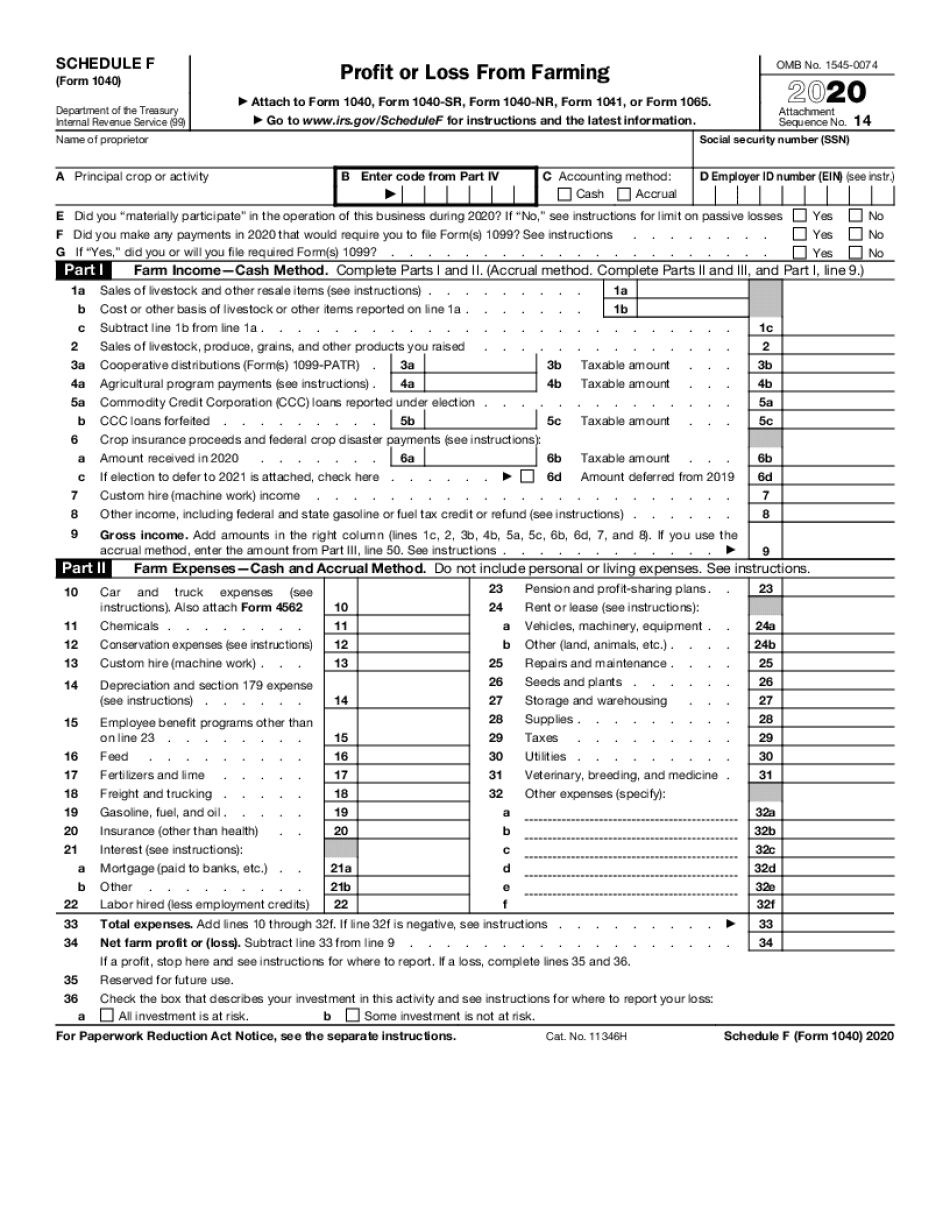

Below is a general guide to which schedule(s) you will need to use based on your circumstances.

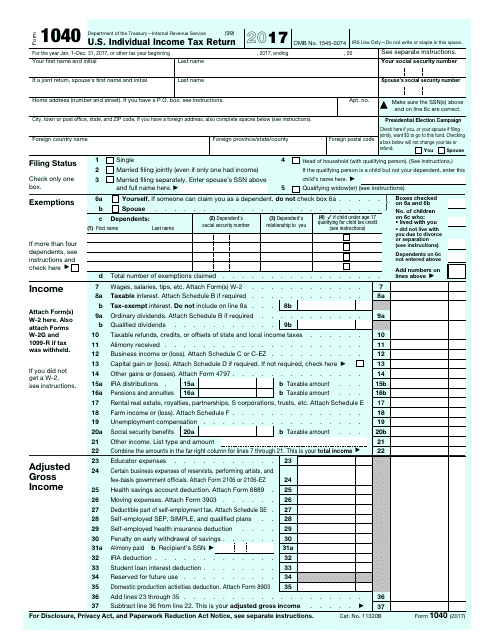

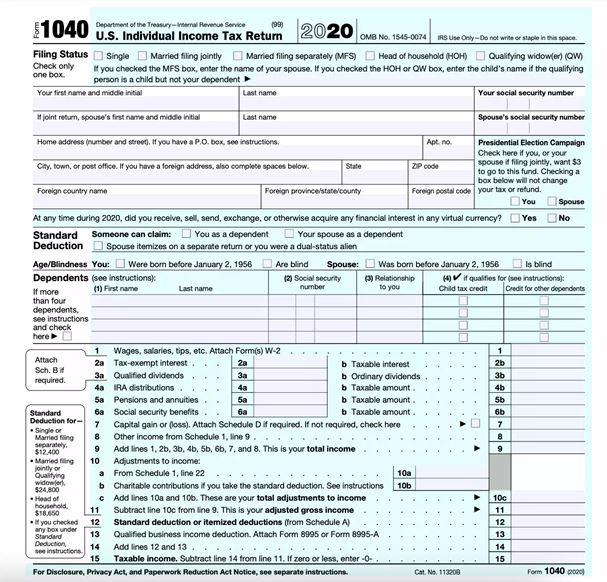

However, if your return is more complicated (for example, you claim certain deductions or credits or owe additional taxes), you will need to complete one or more of the new numbered schedules. Many people will only need to use Form 1040 and none of the new numbered schedules. You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Here are the new 1040 form instructions as of 2019 from the IRS: Previously, the IRS offered different types of Form 1040 – the 1040A and 1040 EZ. You will receive your order by mail, usually within 10 days.With a Form 1040, you can report all types of income, expenses, and credits.

local time - except Alaska and Hawaii, which follow Pacific time - to order current year forms, instructions and publications, as well as prior year forms and instructions by mail. Mail: You can call 1-800-TAX-FORM (1-80) Mondays through Fridays, 7 a.m. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD. Some libraries also have copies of commonly requested publications. On the "Contact My Local Office" page, you can also select " Office Locator" and enter your ZIP code to find the IRS walk-in office nearest you, as well as a list of the services available at specific offices.Ĭonvenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Visit IRS.gov and go to " Contact My Local Office" on the Individuals page to find a list of TAC locations by state. Taxpayer Assistance Centers: There are 401 TACs across the country where the IRS offers face-to-face assistance to taxpayers, and where taxpayers can pick up many IRS forms and publications. The Internet: You can access forms and publications on the IRS website 24 hours a day, seven days a week, at IRS.gov. If you need IRS forms and publications, here are four easy methods for getting them. Because of continued growth in electronic filing, the availability of free options to taxpayers and to reduce costs, the IRS discontinued the automatic mailing of paper tax packages last tax season. The Internal Revenue Service has free tax forms and publications on a wide variety of topics.

Consult your financial or tax adviser regarding your individual situation. Editor’s note: This content is provided by the Internal Revenue Service.

0 kommentar(er)

0 kommentar(er)